Description

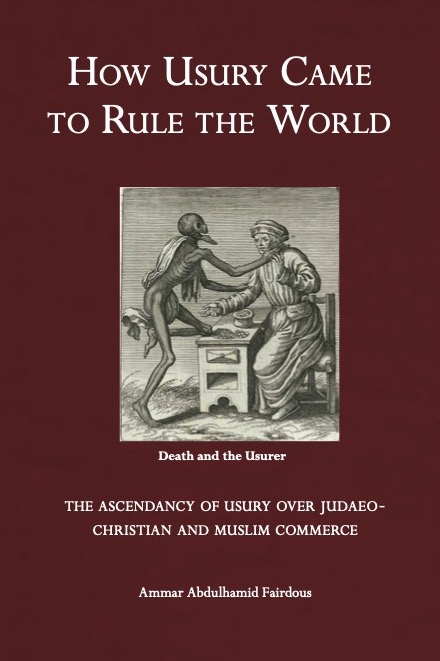

How Usury Came to Rule the World

This thoroughly annotated, well evidenced and orderly book began life as a PhD thesis. Highly readable, it comes as a welcome resource in response to the rapidly expanded appetite for understanding, since the international banking meltdown of 2008, amongst lay readers and specialists alike, regarding all matters relating to the historical roots of modern financial techniques and the question of probity within the banking system. There can be no doubt that the scriptural teachings of Judaism, Christianity and Islam are replete with passages that either explicitly prohibit usury, or which contain unmistakeable evidence that the practice was deeply scorned and unequivocally condemned. What is most fascinating to discover, however, is the logic of the process by which these morally strict anti-usury deterrents transmuted over time to accommodate the more permissive financial practices we see today. The author identifies three principal approaches by which commercial considerations were able to prevail at various points throughout their respective histories, over the scriptural defences against usury so clearly promulgated within the principal Abrahamic religions. The first method was by reinterpreting the concept of usury itself. The second was by exemption, i.e. by excluding the counter-party from the scope of scriptural prohibition. The third method was by the concealment of usury under cover of classical commercial contracts. Intriguingly, none of these methods were exclusive to any one religion, although, for theological reasons, some methods may have been more amenable to the followers of one religion than to the others. At a time when the noise of religious conflict and the clash of civilisations threatens to become deafening, it is also notable that this book, albeit from a rather surprising angle, manages to pay more than mere lip service to the shared historical commonalities between the moral concerns of Judaism, Christianity and Islam as opposed to their differences.

Ammar Abdulhamid Fairdous

Ammar Fairdous undertook various professional qualifications in Business and Management, including Islamic Finance while in the UK. He holds a Master’s degree in International Commercial and Business Law from the University of East Anglia UK (UEA) and a Bachelor’s degree in Islamic Law from Umm Al-Qura University in Saudi Arabia. He completed a doctorate in International Commercial and Business Law at UEA with the thesis entitled, ‘Evading the Taint of Usury: A Comparative Study of the Development of Lending and Credit Law within the Abrahamic Religions (Judaism, Christianity and Islam), which is in essence this book. He has acted in a voluntary capacity as an Imam Khateeb at the reputable Ihsan Mosque in Norwich city centre.

Reviews

There are no reviews yet.